Why do we close the rating list?

You have until 31 March 2026 to request changes to your current valuation for business rates. Here we explain why there’s a deadline.

You have until 31 March 2026 to request changes to your current valuation for business rates. Here we explain why there’s a deadline.

In this blog, you'll find everything you need to know about Revaluation 2026.

In this instalment of our How We Value series, we explain how we value day nurseries and pre-schools across England and Wales.

In this instalment of our How We Value series, we explain how small shops are valued across England and Wales.

In this third part of our blog series, we explain the contractor’s basis method and how it is used to value properties like schools, hospitals and libraries.

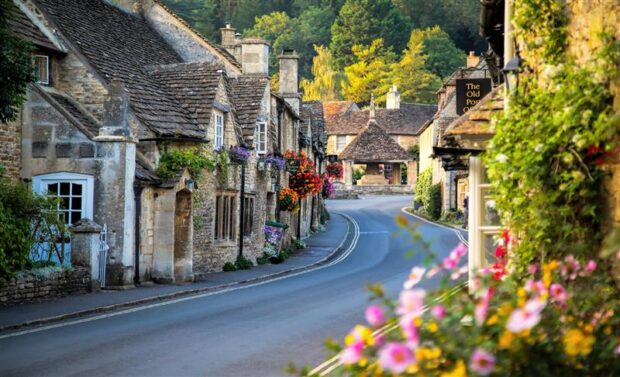

In the second part of our series, we explain the receipts and expenditure method and how it is used to value properties like large hotels and self-catering holiday accommodation for business rates.

In this first part of our three-part blog series, we explain the rental comparison method and how it is used to value properties like shops, pubs and restaurants for business rates.

We look at the evidence you need to support a Council Tax band challenge.

We explore our future approach to sharing information on business rates valuations, and what it will mean for our customers.

In this instalment of our How We Value series, we explain how we value petrol stations across England and Wales.