[English] - [Cymraeg]

Now you’ve read our introduction to business rates, learn more about your business property’s valuation.

How have you valued my property?

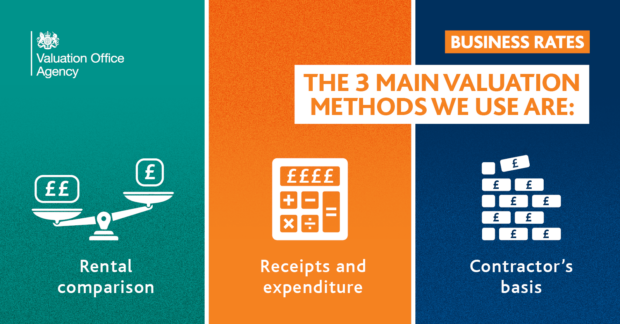

We use recognised valuation methods approved by the Royal Institution of Chartered Surveyors (RICS) when valuing non-domestic properties.

Non-domestic properties are properties that are not used as a main home. They include places like shops, offices, holiday rental homes, stables and beach huts.

Our valuation methods have been clarified and confirmed by court decisions over many years.

How we value depends on the type of property and the evidence available.

Most properties are valued using rental comparison. This is the most common and straightforward valuation method. Shops, offices and factories are valued in this way.

We analyse rental evidence from similar properties to determine a value per metre squared.

We use a different method – receipts and expenditure – when:

- there is little or no rental evidence

- the purpose of the occupation is to generate a profit for the occupier.

This method involves analysing income and expenditure to see what a reasonable rent might be. Hotels, cinemas and self-catering accommodation, for example, are valued this way.

We also use a method called the contractor’s basis in other circumstances. We use this when there is no rental evidence or trading details to analyse. It involves estimating the yearly cost of a replacement property. Properties like hospitals, schools and prisons are valued this way.

Why might my valuation change?

We carry out a ‘revaluation’ of all non-domestic properties on a regular basis. We do this to help ensure business rates bills are based on up-to-date information.

Revaluations are not carried out to generate extra revenue.

When we do a revaluation, we reassess the rateable values of all non-domestic properties in England and Wales.

Rateable values reflect the open market rental value of a property at a specific date.

We carried out a revaluation recently.

Changes in valuations at other times

Sometimes your property valuation might change even if a revaluation is not taking place.

When this happens, it is usually because your property has changed.

For example:

- an extension may have been added

- you may have changed the amount of space you occupy

- you may have changed the way you use the property.

You can tell us if you have made changes to your business property or if you think your rateable value is incorrect. You can read more about how to check and challenge your business rates valuation.

How can I find out more?

Set up a business rates valuation account to find out more about how your rateable value has been calculated.

If you want to find out more about what we’ve covered here, watch our webinar on understanding business rates on our YouTube channel.

We welcome your comments about this blog below but cannot discuss individual cases. Please do not share any personal information. We will not be able to publish any comments that include personal details. Please direct all queries about individual cases to our contact form.

[English] - [Cymraeg]

Dyma’r ail ran o’n cyfres ynghylch deall eich ardrethi busnes. Yma, byddwn yn edrych ar sut rydym yn prisio.

Gan eich bod eisoes wedi darllen ein cyflwyniad i ardrethi busnes, gallwch nawr fynd ati i ddysgu rhagor am brisiad eich eiddo busnes.

Sut ydych wedi prisio fy eiddo?

Rydym yn defnyddio dulliau prisio cydnabyddedig sydd wedi’u cymeradwyo gan Sefydliad Brenhinol y Syrfewyr Siartredig (RICS) wrth i ni fynd ati i brisio eiddo annomestig.

Eiddo annomestig yw eiddo nad yw’n cael ei ddefnyddio fel prif gartref. Er enghraifft, siopau, swyddfeydd, cartrefi gwyliau ar rent, stablau a chabanau glan môr.

Mae ein dulliau prisio wedi cael eu hegluro a’u cadarnhau gan benderfyniadau’r llys dros nifer o flynyddoedd.

Mae’r ffordd rydym yn prisio yn dibynnu ar y math o eiddo sydd dan sylw a’r dystiolaeth sydd ar gael.

Caiff eiddo, gan amlaf, eu prisio drwy ddull o gymharu rhent. Dyma’r ffordd fwyaf cyffredin, mwyaf syml i brisio eiddo. Caiff siopau, swyddfeydd a ffatrïoedd eu prisio yn y ffordd hon.

Rydym yn dadansoddi tystiolaeth rentu o eiddo tebyg i bennu gwerth fesul metr sgwâr.

Byddwn yn defnyddio dull gwahanol – derbyniadau a gwariant – os bydd y canlynol yn berthnasol:

- nid oes digon o dystiolaeth rentu, os o gwbl

- diben y feddiannaeth yw gwneud elw i’r meddiannydd.

Drwy’r dull hwn, byddwn yn dadansoddi incwm a gwariant i weld beth fyddai rhent rhesymol. Caiff eiddo fel gwesty, sinema a llety hunanddarpar ei brisio drwy’r dull hwn.

O dan amgylchiadau eraill, byddwn yn defnyddio dull a enwir yn ‘sail contractwr’. Byddwn yn defnyddio’r dull hwn mewn achos lle nad oes unrhyw dystiolaeth rentu na fanylion masnachu i’w dadansoddi. Drwy’r dull hwn, byddwn yn amcangyfrif y gost flynyddol am eiddo amnewidiol. Caiff eiddo fel ysbyty, ysgol a charchar ei brisio drwy’r dull hwn.

Am ba reswm all fy mhrisiad newid?

Rydym yn cynnal ‘ailbrisiadau’ ar bob eiddo annomestig yn rheolaidd. Rydym yn gwneud hyn er mwyn sicrhau bod biliau ardrethi busnes yn seiliedig ar yr wybodaeth ddiweddaraf.

Nid yw ailbrisiadau yn cael eu cynnal i wneud refeniw ychwanegol.

Wrth i ni ailbrisio, rydym yn ailasesu gwerthoedd ardrethol pob eiddo annomestig yng Nghymru a Lloegr.

Mae gwerthoedd ardrethol yn adlewyrchu gwerth rhent eiddo ar y farchnad agored ar ddyddiad penodol.

Gwnaethom gynnal ailbrisiad yn ddiweddar.

Newidiadau i brisiadau ar adegau eraill

O bryd i’w gilydd, heb i ni gynnal ailbrisiad, mae’n bosibl y bydd prisiad eich eiddo yn newid.

Fel arfer, bydd hyn yn digwydd oherwydd bod eich eiddo wedi newid.

Er enghraifft:

- os ychwanegwyd estyniad i’r eiddo

- os ydych wedi newid y faint o le rydych yn ei ddefnyddio

- os ydych wedi newid sut rydych yn defnyddio’r eiddo.

Gallwch roi gwybod i ni os ydych wedi gwneud newidiadau i’ch eiddo busnes neu os ydych o’r farn bod eich gwerth ardrethol yn anghywir. Gallwch ddarllen ragor am sut i wirio a newid eich prisiad ardrethi busnes.

Sut allaf ddod o hyd i ragor o wybodaeth?

I gael rhagor o wybodaeth am sut mae’ch gwerth ardrethol yn cael ei gyfrifo, crëwch gyfrif prisio ardrethi busnes.

Os hoffech ddysgu rhagor am yr hyn sydd wedi cael ei drafod yma, mae gweminarau ynghylch deall ardrethi busnes ar gael ar ein sianel YouTube.

2 comments

Comment by Louise Coates posted on

Hi I would like to make a complaint please I have it all on email could you let me know how to make. A complaint so I can send it across

Comment by Valuation Office Agency posted on

Hi Louise. To make a complaint, please email complaints@voa.gov.uk. Please provide your name, home address and telephone number, and the address of the property in question (if different from your home address). You can find more information on GOV.UK - https://www.gov.uk/government/publications/valuation-office-agency-complaints-procedure.